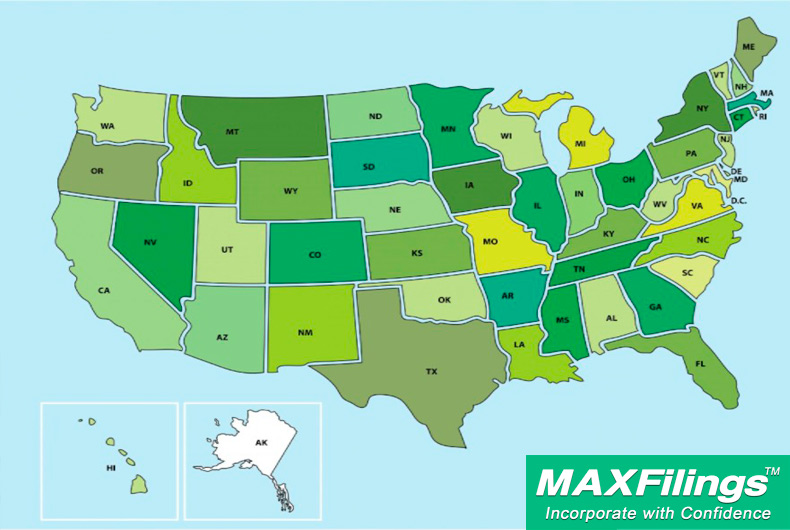

There are many reasons why small business owners choose to register their company in a certain state. Depending on where you live, registering your business can be a pretty simple and affordable process, or an involved and pricey ordeal.

Many businesses, however, choose to register their businesses in states where the rules of incorporation are favorable to their specific situation, rather than the state in which they live or operate their business.

Below are a few things to consider before deciding where to register your business.

1. Corporate Income Tax

Quite a few states are considered tax-friendly to businesses. Texas, Wyoming, Ohio, South Dakota, Nevada, and Washington have no corporate income tax. Wyoming, South Dakota, and Nevada also have no personal income tax. But of these six states, Texas and Ohio do have gross receipt taxes, or a tax on gross revenues.

If your business operates within a state that levies personal or corporate income tax, but you have your business registered in a state that doesn’t, you still must pay taxes for the state in which your business operates. You can’t escape these taxes by registering elsewhere.

Continue reading: Which States Have the Best Business Tax Climate?

2. Formation Costs

Formation fees are paid to the state’s secretary of state office and is a fee that only needs to be paid once. The fee amount varies from state to state. The lowest formation fee of $50 can be found in Mississippi, Arkansas, Oklahoma, Iowa, and Hawaii. The highest formation fee can be found in Connecticut at $455.

3. Legal Resolutions

Delaware is a unique state in that it has a separate court to resolve business disputes. Instead of a jury deciding your case, judges resolve legal matters. This process allows cases to be resolved quickly. Many businesses would rather their cases be reviewed in this manner.

4. Annual Filings and Costs

Formation fees may be a one-off expense, but there are other fees that must be paid annually to keep your business in good standing with the state. Annual requirements generally include submitting a report to the secretary of state’s office that’s one page in length, along with a filing fee. The only two states that don’t require a report are Alabama and Ohio. The annual fees run anywhere from $9 in New York to $325 in Nevada.

5. Franchise Taxes

Some states will also have you pay an annual franchise tax. Whether this is on top of all other fees or in place of them depends on the state. Franchise tax is generally levied on business entities for the privilege of doing business in its state. But for the states that do impose the tax, not all business types have to pay. Some are fully or partially exempt, like non-profits, for example.

6. Investors

If bringing in investors is important to you, then you may want to register your business in Delaware initially. Some investors will even request that you do so prior to investing.

When it comes to choosing the best state in which to incorporate your business, MaxFilings can help you get your business venture started on the right foot. We’ll help you choose a state based on all of the factors listed above as well as you unique situation. Contact us today and we will help you get started.